Tips To Get Certified Payroll Right

Even if a mistake is unintentional, it can be costly. But mistakes can be avoided by taking the right steps.

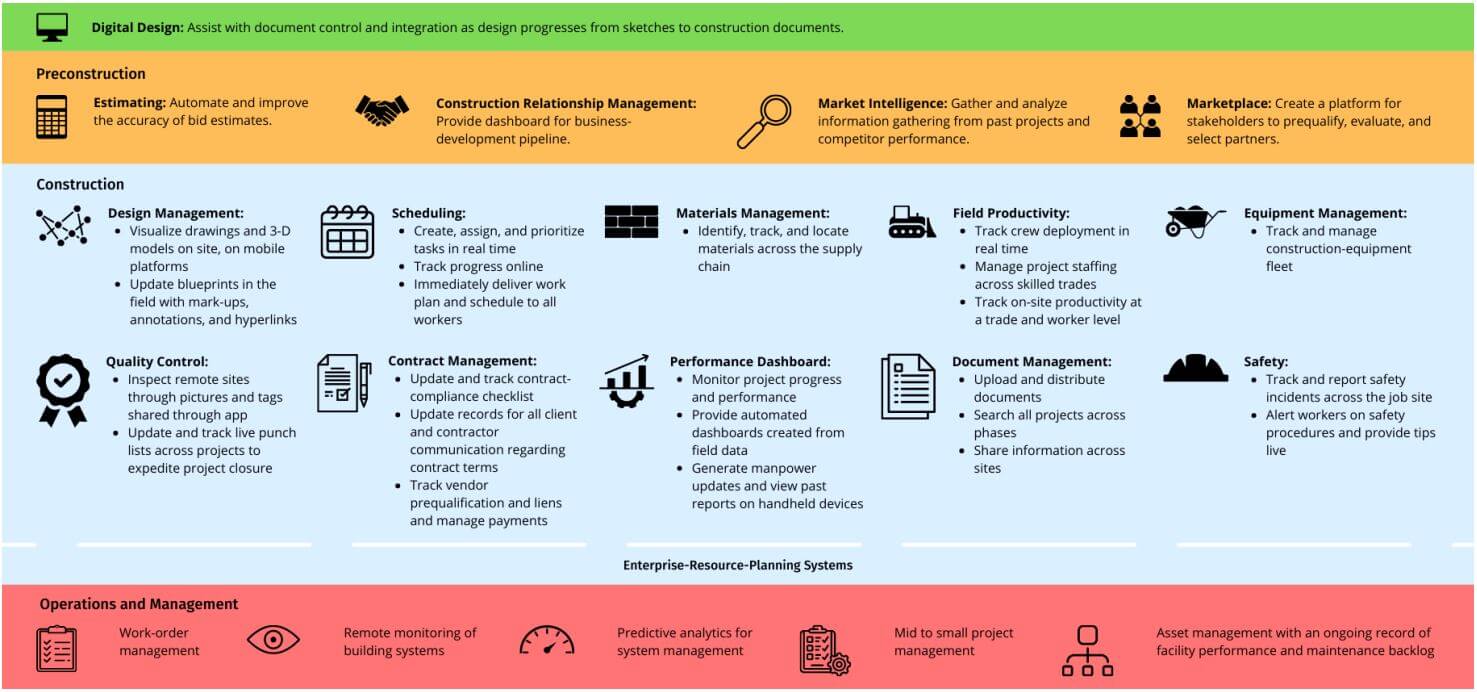

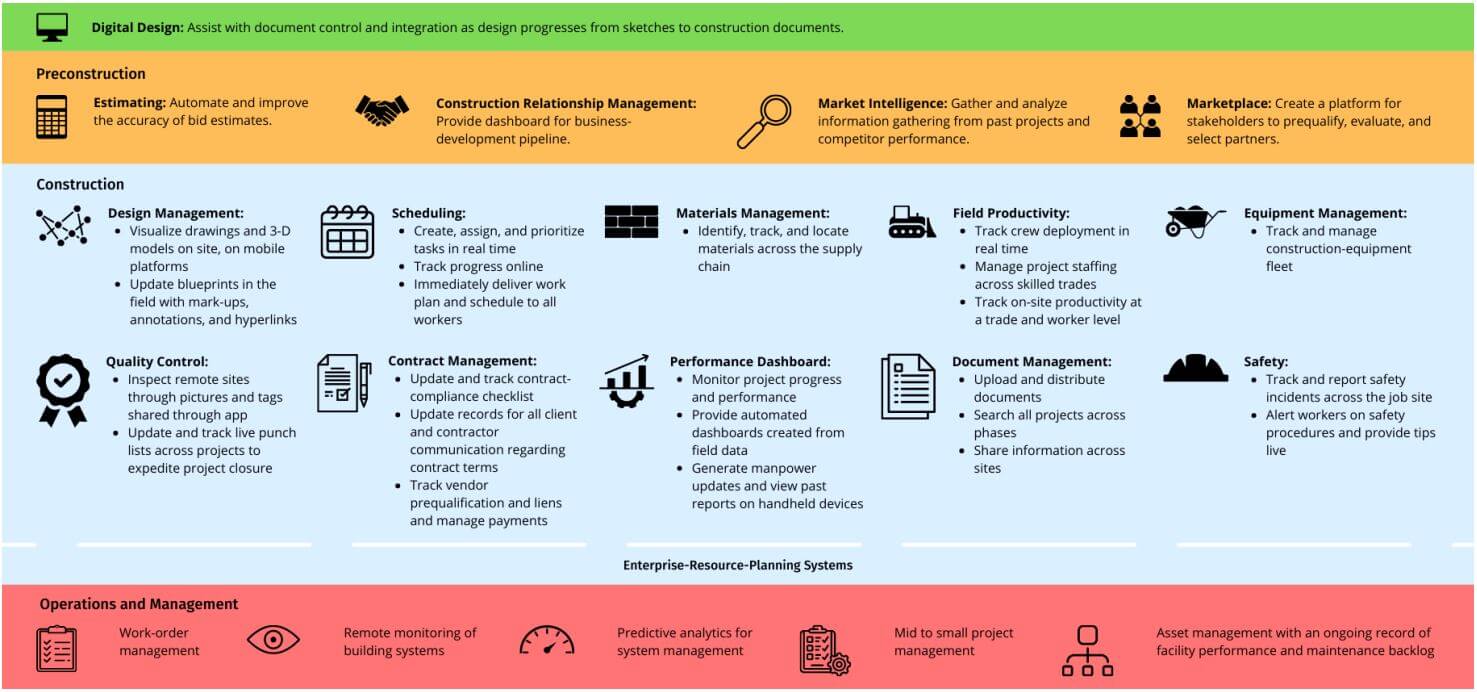

Invest In Technology

As construction and engineering projects become more and more technical and advanced, the most competitive organizations will adopt technology to accommodate these complexities.

Technology helps with everything from design and materials to quality control, safety, and contract management. According to McKinsey, on-site execution relates to “one of the most important aspects of construction” where many construction companies run into issues with many things ranging from low productivity to delays.

To mitigate these issues, technology helps with field productivity by “tracking crew deployment in real time, including the number of active working hours for each team member.”

When it comes to government projects - and certified payroll - the assistance of technology cannot be understated. Tracking crew work, tasks, and hours, will help prevent the misclassification of workers and accidentally paying the incorrect prevailing wage.

Outsource It

If you’re not a numbers person or simply don’t have the time or patience to fill out the required forms and reports accurately and on time, consider outsourcing the job to a qualified professional.

The IRS suggests there are four common third party arrangements companies can make, depending on the specific circumstances:

- Payroll Service Provider (PSP)

- Reporting Agent (RAF)

- Section 3504 Agent

- Certified Professional Employer Organization (CPEO)

They warn, however, regardless of who you choose to hire as a third party, ultimately the employer is still responsible for Federal income taxes.

There are also organizations that specialize in Certified Payroll Reporting such as Points North, who can take care of the process for you.

Be sure to vet any third party you decide to go with, before moving forward.

Get Certified

The American Payroll Association offers a Certified Payroll Professional Examination which provides you with additional training to become a Certified Payroll Professional (CPP). There are multiple benefits to obtaining a CPP certification, not the least of which is learning to get it right. Before you can apply to take the examination, the APA says the payroll professional applying must:

- Have practiced at least a total of three years out of the last five years either

- Payroll Production, Payroll Reporting, Payroll Accounting, Payroll Systems, and Payroll Taxation

- Payroll Administration

- Payroll Education/Consulting

Following these criteria, you must complete additional courses offered by the APA.

These courses will help educate you (and/or your administrators) on best practices, laws, and requirements for fulfilling certified payroll requirements.