When you’re in charge of payroll for a California company, you are responsible for being compliant with California overtime laws.

There are Federal protections for employees, established by the Fair Labor Standards Act (FLSA), that outlines minimum wage and overtime pay rates for employees. California’s overtime laws are similar but tend to be more beneficial to employees than Federal overtime laws.

What are the laws governing overtime wages?

California has additional pay rate and overtime regulations, established by the California Labor Code and the California Industrial Welfare Commission (IWC) Wage Orders. These regulations are enforced by the Division of Labor Standards Enforcement (DLSE).

What is the difference between overtime and FLSA overtime in California?

Under the FLSA, employers are required to pay overtime pay at a rate of 1.5 times a non-exempt employee’s regular pay for any time worked over 40 hours in the week.

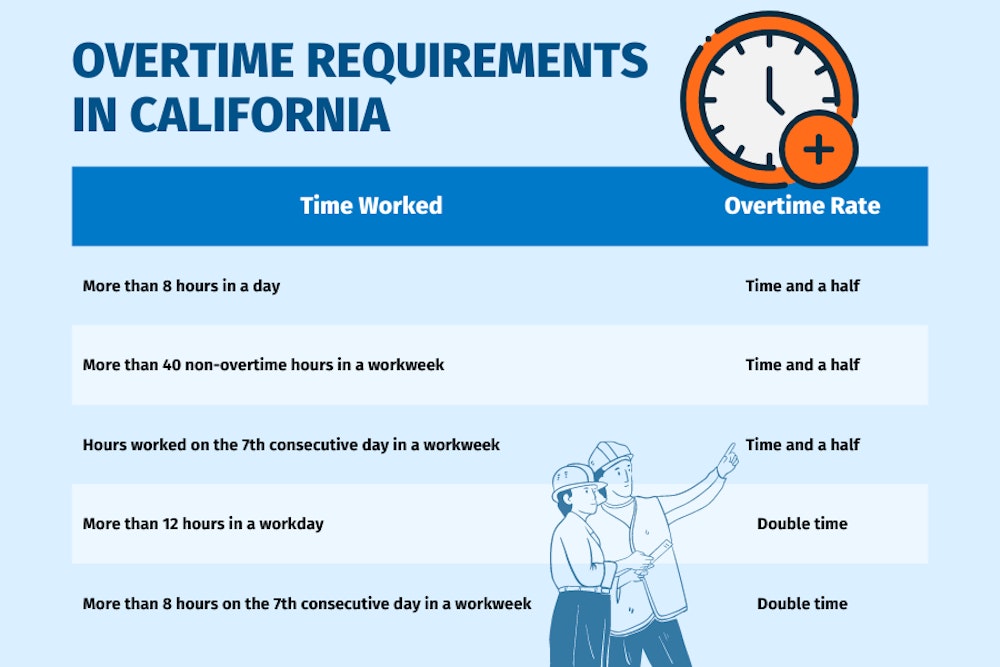

In California, this is extended to include paying 1.5 times the regular pay rate for each hour worked over eight hours in a day, for each hour worked over 40 in a workweek, plus the first eight hours worked on the seventh consecutive day of the week.

Additionally, California employers are required to pay double the regular rate of pay for 12 or more hours worked in a day and for any hours worked over eight on the seventh consecutive day of work.

The FLSA does not require overtime pay for certain agriculture workers, but California overtime law requires overtime pay for any agriculture workers who prepare soil or harvest crops after 10 hours of work and for the first eight hours of the seventh day of consecutive work. Further, double time is required for any hours worked over eight if it’s the seventh consecutive day of work.

What is the new overtime law in California?

California governor Gavin Newsom signed into law SB 1162 in September, 2022, which is an act intended to strengthen pay equity across the state and increase reporting requirements for California employers.

Previously, employers with at least 100 employees were required to provide a pay data report, that characterized employees’ genders, race/ethnicity, and job category, to the EEOC in order to be compliant. SB 1162 extends these reporting requirements to include:

- Employees hired through labor contractors be included in the reporting requirements

- Employers report their mean and median hourly wage data for each combination of gender and race/ethnicity

Employers are required to track job titles and pay rates for each position and submit the mean and median hourly rates by gender and race for:

- Executive or senior-level officials and managers

- First or mid-level officials and managers

- Professionals

- Technicians

- Sales workers

- Administrative support workers

- Craftworkers

- Operatives

- Laborers and helpers

- Service workers

According to the law, the report is to be an overview of a "single pay period of the employer's choice between October 1 and December 31 of the reporting year." These records are to be maintained for the entire time an employee works for the company, as well as three years beyond their employment.

How to calculate overtime in California

California overtime laws apply to most hourly employees and if you’re responsible for managing payroll, you’ll need to understand how to calculate it.

In some cases, overtime is considered 1.5 times the regular pay of that employee, and double time is twice their regular pay. While there are always exceptions and exemptions, as a general rule, the following are California overtime rules: