Labor and tax laws vary and can change. Be sure you research your area and local laws to ensure you are compliant.

Calculating overtime is a vital part of the payroll process, but it gets complicated when dealing with salaried employees or workers at various pay rates. Unless exempt, companies must pay overtime to employees who work more than 40 hours in a given week. There are different calculations for hourly and salaried employees.

To keep your business in good standing, it’s crucial to know the current rules, which employees are subject to them, and how to calculate overtime pay for those employees.

Learn How Mobile Time Tracking Can Help You Calculate Overtime Pay More Efficiently and Accurately

How Does Overtime Work?

A regular work week is made up of 40 hours, as defined in the Fair Labor Standards Act (FLSA) . Any hours that an employee works beyond these 40 hours is considered overtime.

According to the FLSA, companies are required to pay employees a minimum of 1.5 times their regular pay rate for any overtime hours worked. However, some states and circumstances require double overtime — or 2 times the regular pay rate.

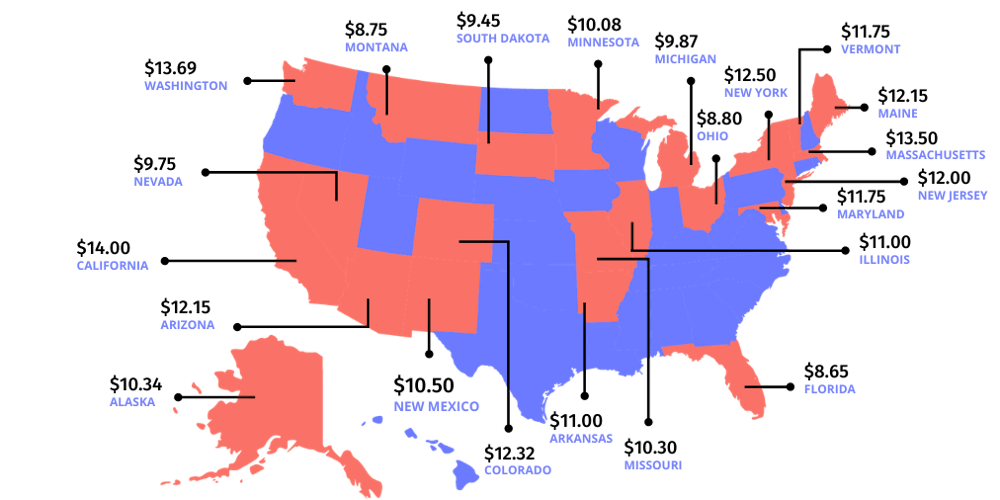

State Requirements for Overtime Pay

Some states have more stringent overtime laws than the federal government. The federal minimum wage, for example, is $7.25; but in California minimum wage is $14/hour, and Arizona, $12.15.

Other states — including California, Colorado, and Alaska — have daily overtime thresholds, meaning that employees are entitled to extra pay if they go above a certain number of hours in a day. In California, employees who work more than 8 hours in a day must be paid 1.5 times their normal pay rate for the extra hours.

For this reason, it’s important to check with your State Labor Office to see the latest laws and regulations. If you work with employees across state lines, check on the regulations in those states, too. For compliance purposes, you must stay up-to-date with state regulations as well as federal laws.

2021 Minimum Wage Increases

Source: Department of Labor

Federal Regulations and Exemptions for Overtime Pay

As of January 1st, 2020, the federal exemption limits for overtime were raised from $455 per week to $684 per week. The increase took place in order to keep up with inflation and rising salaries.

Even if an employee is in a role that is traditionally considered "exempt", such as an executive, administrative, or outside sales role, they are still entitled to overtime pay if they are paid less than $684/week.

What Is the Regular Rate of Pay Under the FLSA?

The regular rate of pay refers to the amount of hourly pay that an employee receives for all regular (that is, non-overtime) work. The FLSA dictates that all employees must be paid, at minimum, the federal minimum wage of $7.25/hour for any hours that they work.

In addition, they must be paid 1.5 times their regular pay rate for any hours above 40 that they work in a given week.

How to Calculate Overtime Pay for Hourly Workers

Calculating overtime pay for hourly workers is mostly straightforward. Any hours that the employee works over a standard workweek will be paid at this overtime rate:

Here’s an example.

Johnny is a security guard for the local parks department. He’s paid $12/hour, and he works from 7am-3pm Monday through Friday, for a total of 40 hours a week. This week, a coworker called in sick and Johnny had to cover two of his shifts, from 3pm-11pm on Thursday and Friday.

Now, Johnny’s working a 56-hour work week. This is 16 hours over the standard 40-hour work week, so those hours are considered overtime.

Johnny’s regular hourly rate of $12 x 1.5 = His overtime rate of $18

For his 16 overtime hours, Johnny will be entitled to a pay rate of $18/hour (1.5 times his normal pay rate). He should be paid $288 for his overtime hours, in addition to his regular paycheck of $480.

Total amount that Johnny receives for his 40-hour workweek plus 16 overtime hours = $768.

What About Employees Who are Paid Multiple Rates?

Employees who work different roles for the same company may be subject to different hourly rates. One common example is a restaurant employee who is paid one hourly rate to serve and a different rate when working as a hostess.

This is called a “blended rate”, and in these cases, the FLSA requires that overtime be paid out using a special weighted average. There are two ways to calculate this average.

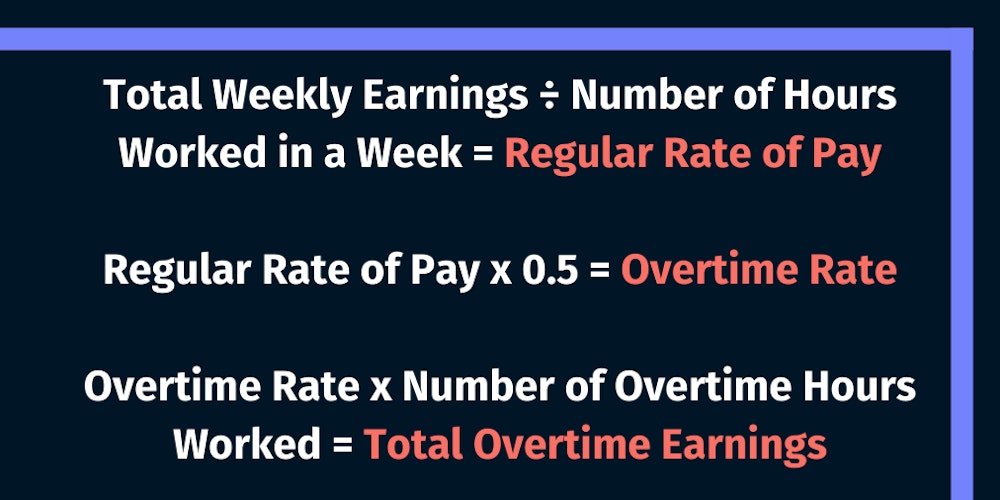

Method 1: Calculate overtime using a weighted average

For this equation, you’ll need to calculate an employee’s regular rate of pay in order to determine their overtime rate.

Here’s an example.

Becky works for a local Italian restaurant where she earns $12/hr as a hostess and $8/hr as a server. This week, she worked 25 hours as a hostess and 20 hours as a server, for a total of 45 hours. Her regular workweek is 40 hours, so she’s owed 5 hours of overtime.

Becky’s earnings for this week can be divided as follows:

Hostess earnings: 25 hrs x $12/hr = $300

Server earnings: 20 hrs x $8/hr = $160

Total earnings = $460

We’ll start by calculating her regular rate of pay according to the above equation. Becky’s total weekly earnings were $460, and she worked 45 hours this week.

$460 ÷ 45 = $10.22

Therefore, her regular rate of pay for this week is $10.22. Now, we’ll multiply that by 0.5 to find her overtime rate.

$10.22 x 0.5 = $5.11

Since Becky worked 5 overtime hours, she’s entitled to an extra $25.55 of overtime pay on top of her total earnings (5 x $5.11 = $25.55).

$460 + $25.55 = $485.55

Becky’s total earnings for this week, including overtime pay, come to $485.55.

While this option is the most accurate, it can be complicated to perform on a weekly basis. An employee’s overtime rate of pay will vary from week to week, depending on how many hours they work in each category.

If you’re doing manual payroll calculations, you may waste a lot of time figuring out the overtime rate every week. A good payroll software will make these calculations for you, and you also have a second, simpler option.

Method 2: Use the highest rate of pay to calculate overtime

For this calculation, you’ll use the employee’s highest rate of pay to calculate overtime.

Here’s how that would work in the case of Becky the server.

Becky works for a local Italian restaurant where she earns $12/hr as a hostess and $8/hr as a server. This week, she worked 25 hours as a hostess and 20 hours as a server, for a total of 45 hours. She’s owed 5 hours of overtime.

Because her highest rate of pay is $12/hr, she’ll be paid an additional 50% (or $6) for every overtime hour worked.

$12 x 0.5 = $6

$6 x 5 hours = $30

Total Becky earned before overtime = $460

Total Becky earns with overtime = $490

As you can see, this calculation is much simpler than the regular rate of pay calculation. However, it does come out slightly higher.

For some businesses that perform manual payroll calculations, it may be worth sticking with the easier option. The difference between payments is minimal, and you'll save time on performing complicated weekly calculations.

On the other hand, larger businesses with lots of employees working overtime will benefit from using a payroll software that automatically calculates an employee's regular rate of pay.

How to Calculate Overtime Pay for Salaried Workers

Figuring out overtime for hourly employees is fairly simple. But the calculations get a bit more complicated when it comes to salaried employees.

First, you’ll need to determine whether the employee is exempt from overtime requirements. As of January 1st, 2020, the DOL states that any employee who is paid more than $684 per week is exempt from overtime pay requirements.

If the salaried employee falls under this threshold, they are entitled to overtime pay. There are two main ways to calculate overtime pay for salaried workers.

1. The Annual Method

For this method, you’ll figure out the employee’s hourly pay using their annual salary and annual hours worked (traditionally 2,080 hrs/year).

Annual salary ÷ Annual hours worked = Hourly rate

Here’s an example. Amy makes $26,000 per year, and she works the regular 2,080 hours per year.

$26000 ÷ 2080 = $12.50

$12.50 x 0.5 = $6.25

Divide $26,000 by 2,080, and you realize that Amy makes $12.50/hour. This means for every overtime hour she works, she is entitled to an additional $6.25 of pay on top of her regular earnings.

2. The Weekly Method

Another way to calculate this is use the employee’s weekly salary and number of hours worked in the week.

Weekly salary ÷ Number hours worked in a week = Hourly rate

Hourly rate x 0.5 = Overtime pay

Here’s an example. Jenny makes $500/week, and she works a regular workweek of 40 hours.

$600 ÷ 40 = $15

$15 x 0.5 = $7.50

Our calculations show us that Jenny makes $15/hour, which means her overtime pay will be $7.50. So, if Jenny works 45 hours in a week, she’ll be paid an additional $37.50 ($7.50 x 5 = 37.50) on top of her regular, salaried pay.

Frequently Asked Questions

How do overtime regulations work for seasonal employees?

This depends on the type of business. Seasonal companies that stay in business for only 7 months or less every year are eligible for an overtime exemption through the FLSA. But companies that operate year-round are required to pay their employees overtime, even if they are seasonal help.

That being said, many seasonal employees are hired on a part-time basis, and the FLSA does not have any regulations regarding part-time workers. For example, if your seasonal employee is hired to work 20 hours each week and they work 30 hours in a week, they are not entitled to overtime pay for those extra 10 hours.

There may be different regulations for part-time workers in your state or in your employment contracts: if you’re unsure, check with an employment lawyer.

An employee worked overtime without going through the proper channels to request authorization. What are the rules for this situation?

You are required to pay overtime whenever an employee works more than 40 hours. In the eyes of the government, it doesn’t matter whether the overtime was pre-approved — any work that occurs over the limit is still considered work time. It’s up to the company to create policies that prevent employees from working unauthorized overtime.

What kinds of payroll records should I keep regarding overtime?

As the Fair Labor Standards Act lays out, companies are required to adhere to certain recordkeeping requirements for overtime pay. There is no specific form provided by the DOL. But, companies must keep accurate and up-to-date information about their employees, the hours they work, and the wages they are paid each pay period.

For a list of the type of records to maintain, refer to Fact Sheet #21 from the US Department of Labor.

Are companies required to pay overtime on holidays and weekends?

Many companies have their own policies regarding overtime rates or extra pay incentives on evenings, weekends, or holidays. These policies are important for employee retention and morale. However, the DOL does not have any stipulations for overtime rates on these days. Check with your employment contracts or union contracts for more information on holiday and weekend pay.

Save Time and Money with ClockShark

Conclusion

Understanding the basic principles of overtime pay will help you manage payroll more effectively. Even though the exact numbers may fluctuate from situation to situation, you’ll be able to easily recognize when your company is out of compliance with federal regulations.

At the end of the day, having a definitive process for calculating overtime pay will benefit your company. Incorporating a time tracking software will simplify the calculations — especially for companies that have salaried employees or employees at multiple pay rates.